The world isn’t as flat as it used to be. Back in 2005 when The World Is Flat: A Brief History of the Twenty-First Century by Thomas Friedman hit bookstores, the one-two punch of globalization and China’s emergence as the world’s workshop seemed an unstoppable force. The view is very different from the perspective of 2022, and a report from Shale Crescent USA (SCUSA) released last month makes the case that offshoring is a spent force.

“China has lost its manufacturing competitive advantage and the annual $25 billion of exported plastic-based goods from China represent a vulnerable and accessible market share opportunity for US operations,” states the report’s executive summary. The long-held belief that it is cheaper to import plastic products is no longer true because, states the summary, “feedstock/resin and transportation are the largest cost drivers of globally produced plastic-based goods.” If you are a regular reader of our Resin Pricing Report, this will not come as news. While some of these trends have been exacerbated by the pandemic, and supply chains are still reeling from its shockwaves, the SCUSA report claims that this shift is not transitory. “Close proximity to low-cost raw materials coupled with direct access to consumer markets provide US manufacturers with significant cost advantages over China-based competitors,” notes the executive summary. “These changes are fundamental, long term, and will continue for the foreseeable future,” it adds.

Now, it’s worth noting that SCUSA is not an unbiased observer. It is a not-for-profit organization established in 2016 to promote the region of Ohio, Pennsylvania, and West Virginia, which sits atop the Marcellus and Utica natural gas fields, deemed to be the most prolific such fields in the United States. (The Shell cracker plant near Pittsburgh, which began operation last month, uses ethane from shale gas producers in the Marcellus and Utica basins. It is the first major polyethylene manufacturing complex in the northeastern United States.)

While SCUSA has a dog in the US vs. China fight, that doesn’t mean the assertions made in this report are unfounded. Clearly, the astronomical cost of shipping, a crippled supply chain, and China’s bizarre zero-COVID policy — a self-inflicted wound on manufacturing and commerce — have radically changed the offshoring calculus. The question is, I suppose, whether this is a permanent reset or a temporary dislocation. We know where SCUSA lands on this question. But, in my opinion, that is not the only consideration.

If we can build it here, we should, because we simply should not be an accessory to China’s ambitions. As Clare Goldsberry documented in PlasticsToday over the years in countless articles before she retired, China does not respect intellectual property rights. More recently, it has become a belligerent force, crushing dissent in Hong Kong, herding minority populations into “re-education” camps, and threatening the status of Taiwan.

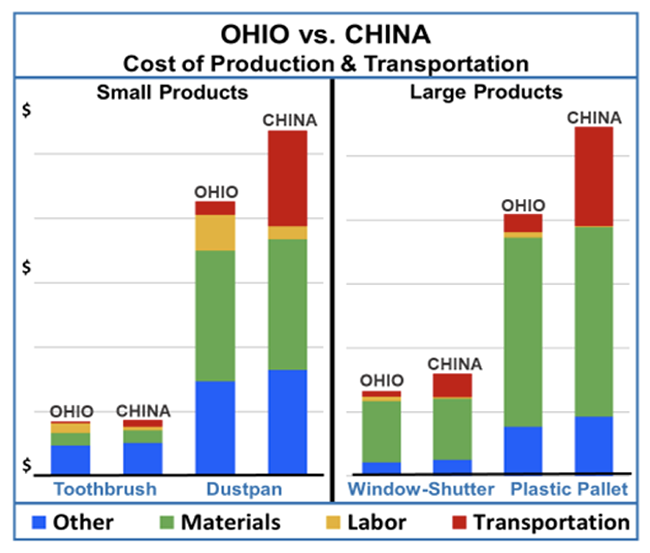

Moreover, it doesn’t even make economic sense to manufacture products in China and ship them over here, according to the SCUSA report. Milacron helped the organization to develop a “production cash flow cost model” that compares the cost of manufacturing plastic products in Ohio versus China. As the graphic below shows, domestic production can be very competitive, and even cheaper in some cases, when transportation is factored in. The cost model is available to processors and can be tailored to take into account specific operation considerations, according to SCUSA.